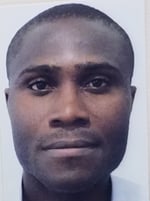

Miller Kingsley

Miller Kingsley Miller is a Fellow of the Nigerian Actuarial Society and a Fellow of the Society of Actuaries. He qualified as a fellow in 2013 in the Life Insurance track. He is also an Associate of the Chartered Insurance Institute of Nigeria. He has over a decade of professional work experience, spanning from a career in a commercial bank, across roles of customer service to internal control, risk management and actuarial practice in Insurance. He currently works with Leadway Assurance, where he operates as the Chief Technical Officer of its new Côte d'Ivoire business. He has a bias for operational efficiency through IT and project management. He is currently the Secretary of the Nigerian Actuarial Society.

How many practicing actuaries do you have?

The Nigerian Actuarial Society should have a reliable count on this before the end of this year, but I believe we have approximately 13 qualified actuaries practicing full-time in country and about 100 others studying to become actuaries. There are a couple of other qualified actuaries practicing full-time in other countries, but doing part-time work in Nigeria.

What is the word for actuary in your local language?

There is no local word for actuary, as far as I am aware (I am probably not the best student of local languages). English is however the lingua franca in Nigeria, so actuary should be the same word used here.

When was actuarial science first introduced?

According to my history, the 1st actuary in Nigeria was Chief Ogunsola, and I believe he qualified approximately 40 years ago. The oldest Bachelor degree in Actuarial Science is from the University of Lagos, and I believe that program started about 40 years ago.

What is your favorite part about being an actuary?

I dislike repeated tasks. I like being an actuary because every day there is a new challenge, and that keeps life interesting for me.

Can you share an interesting anecdote or two from your career?

An interesting highlight for me was around when I got my Associateship—I began to doubt if I had chosen the right career, because I struggled to pass the final Associate ship exam until my 5th attempt. I think the only thing that got me through it was my determination. I recall having a motor accident at five in the morning as I was rushing to the office to check my Fellowship exam results (Internet on the phone was not as available as it is today, so I had to use office internet). The frustration was that I had failed the paper. My first insurance job was also an inflexion point in my career because I started my career in banking and I had to struggle for four years before I got an opportunity to practice full actuarial work, which I needed, to get through the exams.

Do you have any advice for young people in your country interested in pursuing this career?

Attitudinal adjustment is needed in writing the exams—assume you never heard about the topics being studied before and study to understand and practice and not just to pass. Also, be very determined because you will need it. Think big beyond traditional actuarial work and be interested in the holistic business structure (from operations to marketing), so you become not just an actuary, but a good business professional, with the full picture always in mind.

What are some of the highlights of the history of the actuarial profession in your country?

The Nigerian Actuarial Society (NAS) became registered as an educational association around 33 years ago. The NAS became a full member of the IAA in 2018, and we had our first annual conference in 2017.

What are some of the main challenges and projects for your association over the next 5-10 years?

Getting a physical secretariat (we still operate in virtual offices); obtaining more support and recognition from the insurance, financial and pension regulators and other stakeholders; broadening the awareness of the profession (it is still quite unknown); improving relevant regulations in the country, in the areas of of capital, governance and pricing.

What developments on the horizon could affect future opportunities in your country?

Implementation of IFRS 9, IFRS17 and a fully risk-based capital measurement could impact future opportunities of the profession in Nigeria.

What have you seen from inside your company?

Where do you think the changes to actuarial work in your country will happen in the next five years? IFRS 17, which is close on the horizon, promises to be a game changer.

Who are the main employers of actuaries?

Insurance companies and the few actuarial consulting companies in country.

What qualifications do you find most important for upcoming actuaries?

A strong high school background in mathematics. I really believe the foundation is very important. A strong interest in IT and communication is also very important.

Do the schools in your country have actuarial majors, minors, concentrations or do students study on their own or overseas?

Yes, we have some universities offering Bachelors and Masters degrees in Actuarial Science, but the content is not well aligned with current syllabus of the profession. A good number of students planning to practice in country proceed to the UK for a Masters degree after their Bachelors.

What is the credentialing procedure like for an actuary in your country?

The NAS only allows Fellows to sign financial statements. To be a Fellow of the NAS, the member has to be a Fellow of another recognized IAA body, by exam. The NAS does not conduct exams, so all practicing actuaries in country have studied with other bodies (mainly the SOA and IFoA).

Do employers support the cost and time of exam preparation?

The big employers do, but the NAS is still trying to get other employers to join the program.

Are there any noteworthy non-traditional actuarial positions?

Recently, as a result of the introduction of IFRS9, we are beginning to see some requests from commercial banks for actuarial analysts, to analyze credit data. We are also beginning to see Health Management Organizations (HMOs) request actuarial analyst roles. While anyone practicing in the US would expect this to be a traditional actuarial role, this has not been so in Nigeria

What is your favorite Excel function and why?

This is a hard one, but I would say the VLOOKUP function, because it is easy to teach to non-actuarial persons, and I find that across all functions in my office, it is a useful function to use, every now and then.

Do you have any non-actuarial hobbies?

Yes, gardening.

Could you tell us a little bit more about your country or association’s plan for increasing the number of actuaries and actuarial opportunities in Nigeria?

Engage insurance industry CEOs annually (the 1st of these engagements happened in 2018); engage non-traditional employers and sell the profession to them (we plan to do this by involving banks and other financial institutions in our annual conferences).

What could people from outside of your country do to help the profession grow in Nigeria?

One of the main challenges students face is the cost of buying materials and paying for the exams. Any support to subsidize these costs would really help. The NAS will also need support to better engage the relevant stakeholders. The NAS received some financial support from the IFoA in 2018, and it was very helpful in organizing our 2018 annual conference. Support with volunteers to assist with seminars, workshops and so on, would also be very useful. Milliman has graciously planned, at its own cost, to be in Lagos in June, to offer tutorials for Exam P. We need more of such volunteer services to help the profession grow locally.

What can the actuarial society in Nigeria do to help the profession grow worldwide?

We need to ensure global actuarial standards are followed in-country; we need to help improve the image of the profession in Nigeria; we need to grow the number of actuaries qualifying from Nigeria.